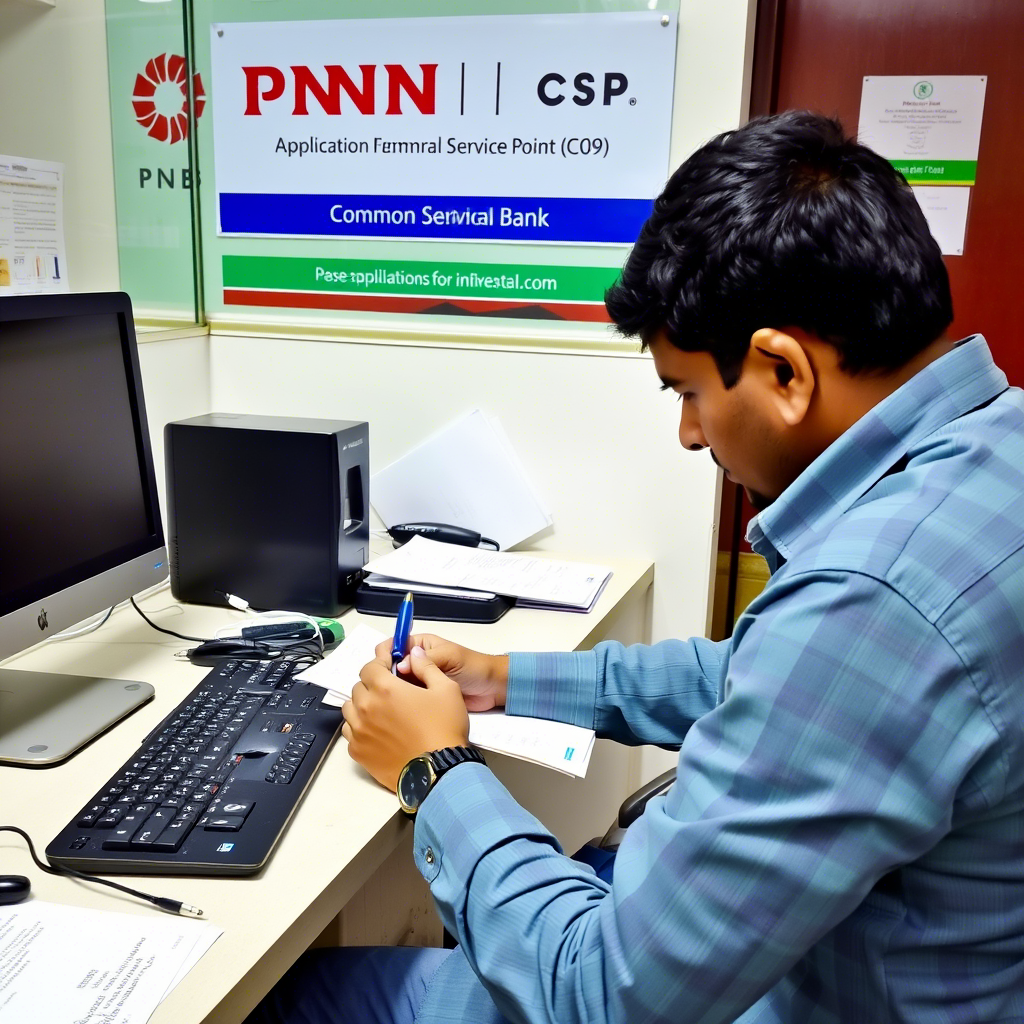

PNB csp apply

Apply For CSP Online

Do you want to start your own business with low investment and high returns? Want to be a part of one of the most trusted banks in India? You have come to the right place. In SaveCSPAPPPLY, we provide you the opportunity to apply online PNB CSP online in some easy stages. Punjab National Bank Customer Service Point (PNB CSP) should start your journey towards financial freedom today.

What is PNB CSP?

PNB CSP, or Punjab National Bank Customer Service Point, is a mini branch operated by individuals like you to offer essential banking services to the general public. This initiative by Punjab National Bank (PNB) is aimed at promoting financial inclusion across rural and semi-urban areas where full-fledged banks are not easily accessible.

Through the PNB CSP apply process via savecspapply, you can start providing basic banking services to people in your community, such as:

Account opening

Deposits and withdrawals

Money transfer

Balance enquiry

Mini statements

Aadhaar-enabled payment system (AEPS)

Bill payments

Insurance and pension scheme enrollments

Why Choose savecspapply for PNB CSP Apply?

At savecspapply, we simplify the PNB CSP apply process for aspiring entrepreneurs. With years of experience and thousands of satisfied applicants, we’ve become a leading platform for CSP registration services. Here’s what makes us different:

User-friendly application process

Fast and secure document verification

Dedicated customer support

No hidden charges

Authorized CSP registration assistance

Whether you’re applying for the first time or switching from another bank, our team at savecspapply ensures a smooth, error-free PNB CSP apply process.

How to PNB CSP Apply Online with savecspapply?

We understand that time is valuable. That’s why our PNB CSP apply online process is straightforward and convenient:

Step 1: Visit savecspapply.com

Head over to our website and click on the PNB CSP apply link.

Step 2: Fill in the Application Form

Provide accurate personal details such as your name, address, contact number, Aadhaar and PAN card details.

Step 3: Upload Necessary Documents

Upload scanned copies of required documents like:

Aadhaar Card

PAN Card

Passport-size photo

Address proof

Educational certificates (10th pass minimum)

Step 4: Verification

Our backend team will verify your documents and initiate the PNB CSP registration with the bank authorities.

Step 5: Get Approval and Start Operations

Once approved, you’ll receive the CSP login credentials and start operating your PNB Customer Service Point.

Benefits of Becoming a PNB CSP through savecspapply

Choosing savecspapply for your PNB CSP apply needs comes with a host of benefits:

✔ Steady Income

Earn commissions on every transaction done at your outlet. The more customers you serve, the higher your income.

✔ Government & Bank Backed

PNB is a government-owned bank. Partnering with it means your business is backed by the Indian banking ecosystem.

✔ Zero Investment in Infrastructure

All you need is a laptop, printer, fingerprint scanner, and internet connection. No need to rent a large office space.

✔ Social Impact

Help people in your locality gain access to banking services and become a respected member of your community.

✔ Training & Support

We provide complete training and support for new agents. Don’t worry if you’re new to the system — we’ve got your back.

Who Can Apply for PNB CSP?

The PNB CSP apply process is open to all eligible individuals who want to make a difference in their community while building a profitable business. You can apply if you are:

A resident Indian above 18 years

Minimum education: 10th pass

Have a valid Aadhaar & PAN card

Basic computer knowledge

Willing to provide service in rural or semi-urban areas

If you meet these criteria, head to savecspapply.com and begin your PNB CSP apply journey today.

Required Infrastructure for PNB CSP

Setting up a PNB CSP is simple and cost-effective. Here’s what you’ll need:

Computer or Laptop

Internet Connection

Printer and Scanner

Biometric Device

UPS or Power Backup

Office space (100 sq. ft. minimum)

Join the Digital India Movement

By registering for PNB CSP apply through savecspapply, you become part of the Digital India movement. You’ll be offering financial services to people who otherwise have to travel miles to access a bank.

Your Customer Service Point (CSP) will bridge the gap between rural citizens and digital banking.

Why Punjab National Bank (PNB)?

Punjab National Bank is one of the largest and oldest government-owned banks in India. Established in 1894, it has a rich legacy of trust, service, and innovation. Becoming a PNB CSP allows you to represent this prestigious bank and gain the trust of your customers.

Frequently Asked Questions (FAQs)

❓ What is the earning potential from a PNB CSP?

You can earn between ₹10,000 to ₹40,000 per month depending on the number of transactions and services you offer.

❓ Is there any fee for PNB CSP apply?

savecspapply does not charge any hidden fees. The registration process is transparent and cost-effective.

❓ How long does it take to get CSP approval?

Once your documents are submitted and verified, you may receive approval in 7–15 working days.

❓ Can I operate multiple CSPs?

Yes, subject to approval and area availability.

❓ Is training provided after registration?

Yes, we provide complete training and support to all our CSP agents.